EUR 170 million for climate technology startups

AENU successfully closes first fund above target-size, with reputable LPs and a focus on early stage investments in energy transition and carbon economy

- Fund size: EUR 170 million final-closing near hard-cap, significantly exceeding the target fund size of EUR 140 million.

- Investors: Institutional Limited Partners such as EIF, KfW Capital, Bertelsmann, Rentenbank, alongside well-known serial entrepreneurs Lawrence Leuschner (TIER), Anna Alex (Planetly), Michael Wax (Forto), Niklas Zennström (Skype) and family offices like E.R. Capital Holding.

- Differentiation: AENU differentiates from the market with a research-led investment approach and portfolio value-add on entrepreneurial sparring and Impact-as-a-Service.

- Portfolio: early success stories including Alcemy (low-carbon cement), Monta (e-charging software), Ocell (sustainable forestry), Trawa (energy management) and HomeTree (home decarbonization).

Berlin, [September 11, 2024] – AENU, one of Europe’s leading Article 9 Climate Tech VC Funds, announces the closing of its first fund with a volume of €170 million. The initial target of €140 million was significantly exceeded. The fund focuses on Seed and Series A investments in climate technologies in Northern Europe, and aims to drive the energy transition and the carbon economy. Beyond its investments, AENU aims to contribute to the systemic transformation towards #ImpactCapitalism, aligning financial performance with positive climate impact.

AENU’s journey started in 2022 with an evergreen fund-structure that allowed it to contribute to the democratization of the asset-class, achieve long-term stakeholder-alignment and create novel liquidity-options for LPs. In 2023, with realization that the innovative structure was not palpable to the institutional LP market, AENU modified the structure. This pivot ultimately unleashed the investor demand for AENU I, which led to the successful € 170 million final close that is announced today.

Investors: Oversubscription shows strong investor confidence

The success of this fundraising demonstrates the growing confidence of the LP market in AENU’s strategy and team. The fund’s investors include institutional investors, e.g. EIF, Rentenbank, Bertelsmann, KfW Capital as well as prominent German entrepreneurs and family offices such as E.R. Capital Holding, who have recognized the importance of investing at the intersection of market-rate financial returns and climate impact.

Differentiation: research-led investing and value-add with entrepreneurial sparring and Impact-as-a-Service

AENU pursues a research-led and science-based approach to developing its investment thesis. The in-house team conducts multiple research-projects per year (so-called “Deep Dives”) in specific sub-categories of energy transition and carbon economy. Recent examples include a) carbon removal via direct air capture and mineralisation, b) energy-flexibility behind-the-meter, c) climate risk & analytics. About 70 % of AENU’s active investments have been won by outbound deal-sourcing based on such deep-dives. The firm publishes its research on its website (https://www.aenu.com/insights/), providing founders and investors with valuable insights into markets and tech trends.

AENU adds significant value to the founders of its portfolio companies by providing personalized entrepreneurial guidance and advice on strategic and operational matters, offered by seasoned entrepreneurs who have a proven track record of building unicorn companies and successful exits. The firm has also developed a unique Impact-as-a-Service offering, including e.g. impact measurement, impact reporting, Life-Cycle-Assessments (LCAs), CSRD-readiness and Theory-of-Change (TOC) development.

Portfolio success stories

AENU invests specifically in companies that contribute to solving the climate crisis. Notable investments on the active portfolio of AENU include:

Alcemy: Uses data-driven technologies to optimize concrete production, leading to significant reductions in CO2 emissions in the construction industry. Berlin, GER. Co-Investors: LocalGlobe, Galvanize, Norssken.

Monta: A leading provider of software solutions for electric vehicle charging infrastructure management, optimizing the charging network for the energy transition. Copenhagen, DK. Co-Investors: Creandum, Energize, Headline.

Trawa: Specializing in intelligent energy measurement and optimization for industrial applications, Trawa contributes to increasing efficiency and reducing energy consumption. Berlin, GER. Co-Investor: Balderton.

Ocell: Develops solutions for monitoring and reducing CO2 emissions in real time, Ocell helps companies achieve their climate targets faster. Munich, GER. Co-Investor: Summitteer.

Hometree: Provides solutions for the installation and maintenance of energy-efficient heating systems, helping homeowners reduce their carbon footprint. London, UK. Co-Investors: 2150, EIP, LocalGlobe.

From the fund’s existing portfolio of already more than 20 companies, the first 9 companies have been able to demonstrate successful up-rounds to date.

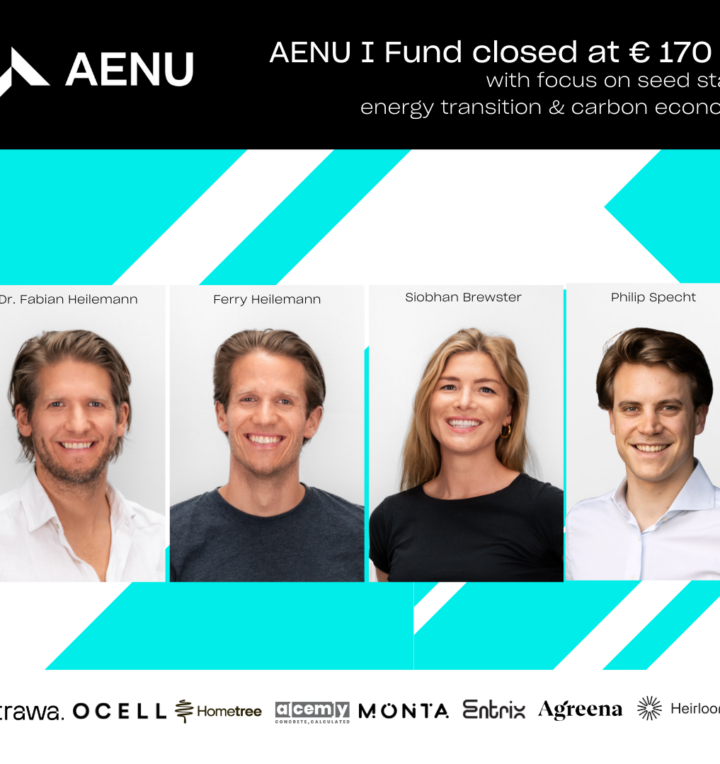

Statements from the team

Fabian Heilemann, Founder & CEO of AENU: “The strong demand for AENU’s final closing demonstrates that climate impact investing has emerged from a niche to the mainstream of the Venture Capital market. We are proud to be drivers of the systemic transformation in our industry by open-sourcing our scientific impact-methodology to other managers and delivering unique Impact-as-a-Service to our portfolio companies.”

Ferry Heilemann, Founder & Partner: “Our north star is to maximize our impact by finding companies that have the potential to reduce and remove 50 million tons of CO2 at scale. Since we are committed to advancing the entire climate transition, our approach is collaborative within the VC ecosystem, and we are working alongside impactful NGOs like Leaders for Climate Action, Founder’s Pledge, and Clean Air Task Force.

Siobhan Brewster, Partner: “With our in-house research we are developing specific investment theses that empower us to discover and close investment opportunities in the market with speed and determination. The founders notice and reward, when an investor has built specific domain expertise in their market.”

Philip Specht, Partner: “Joining from a generalist fund at the beginning of the year, it is great to now be part of a team that is characterized by a rare combination of commercial track record and impact DNA, striving every day to empower the most ambitious and impact-minded climate tech founders in Europe”.

About AENU

AENU is an Article 9 climate tech VC fund, focused on European early-stage companies in energy transition and the carbon economy. Its diverse team includes former unicorn founders (Forto), climate activists (LFCA) and institutional investors (Earlybird/ Macquarie/ Speedinvest). Their impact methodology is frequently quoted by experts. The portfolio achieved several up-rounds and recent investments include Monta (Creandum, Energize), Alcemy (Galvanize, Local Globe), Agreena (HV, Kinnevik) and Trawa (Balderton)

Contact

Katharina Beitz

Mail: katharina@aenu.com

+49-151- 414 31 558