Why we invested in Agreena

The Problem

In our quest to optimize profits, farmers all around the world are treating farmland like a poorly oiled engine. We – I’m a farmer’s daughter myself – think about agriculture as an input-output process: increasing yield, while minimizing inputs like fertilizers or machinery. However, our soils are a complex system of natural interdependencies.

By simplifying our understanding of how the system works, we are instead leaving yield and money on the table, while at the same time contributing to higher greenhouse gas emissions. 46% of the Earth’s soil is used for agriculture. One quarter of global greenhouse gas emissions are associated with the food production value chain, and up to 30% of the world’s cropland has been degraded.

The Solution

To confront these challenges, regenerative agriculture has emerged as one of the best nature-based solutions to meet global net zero goals while feeding our planet, with a potential impact of up to 3 Gt CO2e / year.

Fundamentally, regenerative agriculture is an alternative means of producing food through a combination of sustainable agricultural practices: from no tillage or synthetic chemicals to diversifying crops and soil coverage. These practices take a holistic approach to regenerating natural ecosystems, and specifically, soil.

However, regenerative agriculture practices can be costly and risky to implement for farmers. For example, farmers might experience lower yields for a few years or might require new expensive machinery. Solutions that de-risk the transition to regenerative agriculture, and lock-in farmers to sustainable practices for years to come, are best poised to succeed, both in financial and impact terms.

Who is Agreena

Agreena is the #1 soil carbon credit platform for regenerative agriculture in Europe. Its vertically-integrated platform mints, verifies and sells (soil) carbon credits generated by farmers to provide an economic incentive to switch from traditional arable farming to regenerative agricultural methods. The platform allows farmers to onboard their fields, calculate the potential upside from soil carbon credits by switching to regenerative farming, and then track the progress. Going forward, the platform will also offer other innovative financing solutions to support farmers on their regenerative agriculture journey.

Why Agreena

AENU spent months understanding the biggest impact levers and commercial opportunities in the AgTech sector. In regenerative agriculture, there are a few dimensions that we were looking for and where Agreena exceeded all of our expectations:

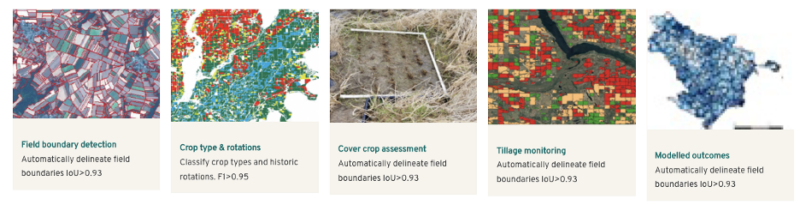

- Industry expertise: Although being a regenerative agriculture farmer is not a precondition to building a business in this space, there are a few areas of expertise that matter: (1) robust scientific team and (2) established relationships in the buyers and sellers market. Agreena’s acquisition of Hummingbird Technologies, in addition to the strongest C-level suite we have seen in regenerative agriculture, led by co-founders Simon Haldrup and Julie Koch Fahler, make the company stand out from its competition.

- MRV scalability: there is an inherent tension between specificity and scalability in soil carbon measurement. We believe a practice-based approach that combines soil samples in model calibration and verification plus satellite imagery data provides the right balance between quality and reach. In addition, Agreena’s alignment to VERRA’s VM0042 standard is a needed stamp of approval for many buyers.

- Land grab: to minimize the risk of impact reversal, where farmers go back to traditional, non-sustainable practices, it is critical to lock them into long-term contracts (10 yrs+). Because of this lock-in effect, companies that are able to capture as many farmers as possible and as fast as possible will be able to scale fastest in the soil carbon credit market. Only then should startups focus on increasing farmers’ share of wallet. Agreena already has the most hectares under management (HuM) in Europe, and they are still at the beginning of their journey.

- Beyond soil carbon credits: Soil carbon credits won’t be the only reason why farmers experiment with regenerative agriculture. Companies that deeply understand and serve farmers’ switching pain points – from CAPEX to knowledge sharing – will be best positioned for success. One of the biggest untapped opportunities is to offer financial services to farmers that are not currently met by their traditional banks, and Agreena is doing just that.

Given the company’s current market leading position in Europe, and the additional fuel from the Series B financing round, Agreena will not only be able to solidify its position thanks to network effects and long-term contract lock-ins, but also attract more buyers to the soil carbon credit market.

Agreena raised €42M in Series B funding. Led by one of Germany’s leading investors, HV Capital, the round brings together an exciting composition of new investors with impact fund AENU and fintech specialist Anthemis. The round also holds support from existing investors including Gullspång Re:food, Kinnevik, and Vaekstfonden. Read the full press release here.