Why we invested in Alcemy

Our build environment is largely dependent on concrete and we believe that this dependency will continue in the next decades as the global population turns more towards urban environments. However, our planet is also facing a grave climate crisis and we need to consider how to reduce the carbon footprint of cement, concrete’s main ingredient, which accounts for 8% of global CO2 emissions.

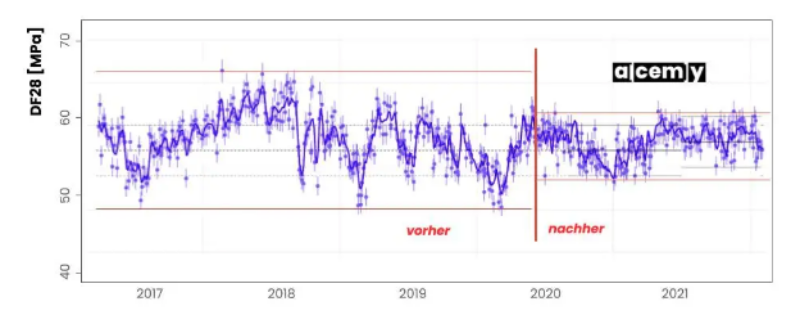

According to the IEA the cement industry is not on track of reaching its Net Zero Emission goal by 2050. Between 2015 and 2020 CO2 intensity of cement production increased by 1.8% per year, instead it should be declining 3% by 2030. ~80% of concrete’s CO2 emissions come from its cement. Further, ~95% of cement’s CO2 emissions are based on its content of clinker. Consequently, a key solution of lowering those CO2 emissions is to reduce the clinker-to-cement ratio. However, reducing that ratio also increases the volatility in quality, i.e. creates a less stable quality in cement and concrete. Low quality concrete is an unacceptable risk for the construction industry. Consequently a solution is needed where clinker ratio can be reduced but quality is kept at its level.

Alcemy provides a software solution enabling cement and concrete producers to lower the clinker ratio and consequently produce cement and concrete with 50% lower CO2 emissions while keeping the quality on target. By using the software, Alcemy’s customers already save more than 80.000 tons of CO2 every year. In addition, three customers (Dyckerhoff, Märker and Spenner) feel confident enough in using Alcemy to launch a new cement with a significantly lower CO2 footprint.

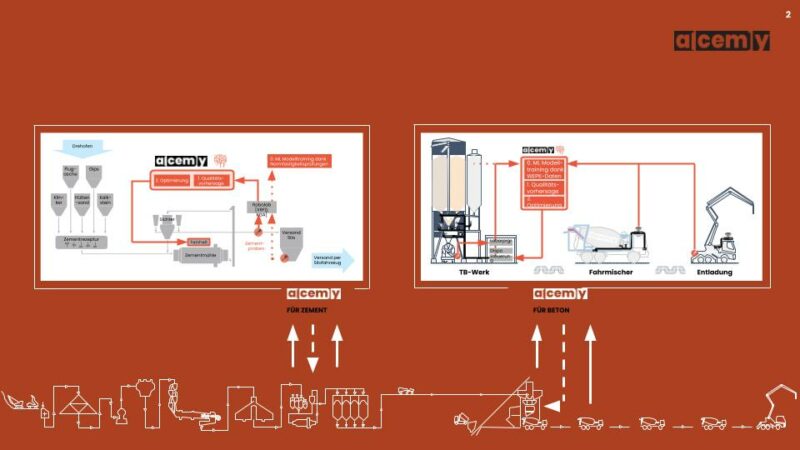

Alcemy’s product in cement and concrete

Source: Alcemy

Alcemy bridges the advantages of two competitive landscapes and can be seen as complementary to most companies but with unique advantages among its peers. The first group is software/IoT companies increasing the efficiency of cement and concrete production facilities and consequently optimizing for less energy consumption. Examples include CarbonRe or Jungle.ai. The second group of companies forms around the creation of new materials, either substituting clinker, cement or lime stone and doing so based on chemical processes (Brimstone or Sublime) or use of recycled material (CarbonCure, CemVision or EcoLocked).

Alcemy’s impact on avoidance of CO2 emissions is highly dependent on how its customers apply the software and to which extent the market adopts low carbon cement and concrete. Their vision is to avoid 0.2 GT of CO2 by 2030 and 1 GT of CO2 by 2040 which is in line with AENU’s benchmark of 100 MT CO2 avoided or captured at scale on technology level. With today’s materials, Alcemy can lower the CO2 emissions of cement and concrete production by ~50%.

AENU is especially impressed by Alcemy’s evidence of their impact – the reduction of clinker is widely accepted as a successful measure. But they also convince in their impact additionality, providing a solution in a difficult to decarbonise and access market.

Alcemy has a unique advantage when it comes to accessing this traditional and less tech savvy customer base of cement and concrete producers: The Co-founder and CEO Leopold Spenner’s long history in the industry. Robert Meyer, Co-founder and CTO and his team of developers complement these industry insights perfectly with strong data science capabilities. Together, the market insights and tech innovation have created Alcemy’s high credibility along all different positions in a cement plant.

Leopold and Robert have built a mission driven and highly engaged team around them. Alcemy is ready to transform an analogue and high emitting industry into a digitally optimized and climate friendly one at international scale.

Also see how Alcemy concrete is used for the Amazon Edge tower in Berlin.

Alcemy raised €10M in their Series A funding. The round was led by Galvanize Climate solutions and included funding from AENU, BitStone Capital, MOMENI Ventures, E.R. Capital Holding, Tobias Nendel, Flixbus founders, and existing investors EF, La Famiglia, Firstminute Capital, and LocalGlobe.